Token generating component

Huxham , et al.

U.S. patent number 10,304,047 [Application Number 14/648,510] was granted by the patent office on 2019-05-28 for token generating component. This patent grant is currently assigned to Visa International Service Association. The grantee listed for this patent is Visa International Service Association. Invention is credited to Horatio Nelson Huxham, Tara Anne Moss, Alan Joseph O'Regan, Hough Arie Van Wyk.

| United States Patent | 10,304,047 |

| Huxham , et al. | May 28, 2019 |

| **Please see images for: ( Certificate of Correction ) ** |

Token generating component

Abstract

The invention provides a method and system for providing financial details from a mobile device of a user for use in a transaction. The method is performed on a mobile device of the user and includes the steps of generating, on a token generating component, a session-specific token by applying an algorithm requiring a dynamic key; providing financial details for use in a transaction; incorporating the session-specific token and the financial details into a modified form the financial details; and transferring the modified form of the financial details from the mobile device to initiate the transaction. A corresponding method and system for validating financial details received, at a server of an issuing authority, is also provided.

| Inventors: | Huxham; Horatio Nelson (Cape Town, ZA), O'Regan; Alan Joseph (Cape Town, ZA), Van Wyk; Hough Arie (Cape Town, ZA), Moss; Tara Anne (Cape Town, ZA) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Applicant: |

|

||||||||||

| Assignee: | Visa International Service

Association (San Francisco, CA) |

||||||||||

| Family ID: | 50882882 | ||||||||||

| Appl. No.: | 14/648,510 | ||||||||||

| Filed: | December 6, 2013 | ||||||||||

| PCT Filed: | December 06, 2013 | ||||||||||

| PCT No.: | PCT/IB2013/060696 | ||||||||||

| 371(c)(1),(2),(4) Date: | May 29, 2015 | ||||||||||

| PCT Pub. No.: | WO2014/087381 | ||||||||||

| PCT Pub. Date: | June 12, 2014 |

Prior Publication Data

| Document Identifier | Publication Date | |

|---|---|---|

| US 20150302390 A1 | Oct 22, 2015 | |

Foreign Application Priority Data

| Dec 7, 2012 [ZA] | 2012/09284 | |||

| Current U.S. Class: | 1/1 |

| Current CPC Class: | G06Q 20/327 (20130101); G06Q 20/3229 (20130101); G06Q 20/382 (20130101); H04W 12/004 (20190101); H04L 63/067 (20130101); G06F 21/35 (20130101); H04W 12/0608 (20190101); H04L 63/068 (20130101); G06F 2221/2137 (20130101) |

| Current International Class: | G06Q 20/32 (20120101); G06F 21/35 (20130101); G06Q 20/38 (20120101); H04L 29/06 (20060101); H04W 12/06 (20090101) |

| Field of Search: | ;705/67 |

References Cited [Referenced By]

U.S. Patent Documents

| 4423287 | December 1983 | Zeidler |

| 5412730 | May 1995 | Jones |

| 5613012 | March 1997 | Hoffman |

| 5781438 | July 1998 | Lee |

| 5883810 | March 1999 | Franklin |

| 5953710 | September 1999 | Fleming |

| 5956408 | September 1999 | Arnold |

| 5956699 | September 1999 | Wong |

| 6000832 | December 1999 | Franklin |

| 6014635 | January 2000 | Harris |

| 6044360 | March 2000 | Picciallo |

| 6058193 | May 2000 | Cordery |

| 6112187 | August 2000 | Fukawa |

| 6163771 | December 2000 | Walker |

| 6227447 | May 2001 | Campisano |

| 6236981 | May 2001 | Hill |

| 6267292 | July 2001 | Walker |

| 6327578 | December 2001 | Linehan |

| 6341724 | January 2002 | Campisano |

| 6385596 | May 2002 | Wiser |

| 6422462 | July 2002 | Cohen |

| 6425523 | July 2002 | Shem Ur |

| 6592044 | July 2003 | Wong |

| 6636833 | October 2003 | Flitcroft |

| 6667700 | December 2003 | McCanne |

| 6748367 | June 2004 | Lee |

| 6805287 | October 2004 | Bishop |

| 6879965 | April 2005 | Fung |

| 6891953 | May 2005 | DeMello |

| 6901387 | May 2005 | Wells |

| 6931382 | August 2005 | Laage |

| 6938019 | August 2005 | Uzo |

| 6941285 | September 2005 | Sarcanin |

| 6980670 | December 2005 | Hoffman |

| 6990470 | January 2006 | Hogan |

| 6991157 | January 2006 | Bishop |

| 6996722 | February 2006 | Fairman |

| 7011247 | March 2006 | Drabczuk |

| 7051929 | May 2006 | Li |

| 7069249 | June 2006 | Stolfo |

| 7069439 | June 2006 | Chen |

| 7103576 | September 2006 | Mann, III |

| 7113930 | September 2006 | Eccles |

| 7136835 | November 2006 | Flitcroft |

| 7177835 | February 2007 | Walker |

| 7177848 | February 2007 | Hogan |

| 7194437 | March 2007 | Britto |

| 7209561 | April 2007 | Shankar et al. |

| 7213766 | May 2007 | Ryan |

| 7264154 | September 2007 | Harris |

| 7287692 | October 2007 | Patel |

| 7292999 | November 2007 | Hobson |

| 7350230 | March 2008 | Forrest |

| 7353382 | April 2008 | Labrou |

| 7379919 | May 2008 | Hogan |

| RE40444 | July 2008 | Linehan |

| 7415443 | August 2008 | Hobson |

| 7430668 | September 2008 | Chen |

| 7444676 | October 2008 | Asghari-Kamrani |

| 7469151 | December 2008 | Khan |

| 7548889 | June 2009 | Bhambri |

| 7567934 | July 2009 | Flitcroft |

| 7567936 | July 2009 | Peckover |

| 7571139 | August 2009 | Giordano |

| 7571142 | August 2009 | Flitcroft |

| 7580898 | August 2009 | Brown |

| 7584153 | September 2009 | Brown |

| 7593896 | September 2009 | Flitcroft |

| 7606560 | October 2009 | Labrou |

| 7627531 | December 2009 | Breck |

| 7627895 | December 2009 | Gifford |

| 7650314 | January 2010 | Saunders |

| 7685037 | March 2010 | Reiners |

| 7702578 | April 2010 | Fung |

| 7707120 | April 2010 | Dominguez |

| 7712655 | May 2010 | Wong |

| 7734527 | June 2010 | Uzo |

| 7753265 | July 2010 | Harris |

| 7770789 | August 2010 | Oder, II |

| 7784685 | August 2010 | Hopkins, III |

| 7793851 | September 2010 | Mullen |

| 7801826 | September 2010 | Labrou |

| 7805376 | September 2010 | Smith |

| 7805378 | September 2010 | Berardi |

| 7818264 | October 2010 | Hammad |

| 7828220 | November 2010 | Mullen |

| 7835960 | November 2010 | Breck |

| 7841523 | November 2010 | Oder, II |

| 7841539 | November 2010 | Hewton |

| 7844550 | November 2010 | Walker |

| 7848980 | December 2010 | Carlson |

| 7849020 | December 2010 | Johnson |

| 7853529 | December 2010 | Walker |

| 7853995 | December 2010 | Chow |

| 7865414 | January 2011 | Fung |

| 7873579 | January 2011 | Hobson |

| 7873580 | January 2011 | Hobson |

| 7874010 | January 2011 | Perlman |

| 7890393 | February 2011 | Talbert |

| 7891563 | February 2011 | Oder, II |

| 7896238 | March 2011 | Fein |

| 7908216 | March 2011 | Davis et al. |

| 7922082 | April 2011 | Muscato |

| 7931195 | April 2011 | Mullen |

| 7937324 | May 2011 | Patterson |

| 7938318 | May 2011 | Fein |

| 7954705 | June 2011 | Mullen |

| 7959076 | June 2011 | Hopkins, III |

| 7996288 | August 2011 | Stolfo |

| 8025223 | September 2011 | Saunders |

| 8046256 | October 2011 | Chien et al. |

| 8060448 | November 2011 | Jones |

| 8060449 | November 2011 | Zhu |

| 8074877 | December 2011 | Mullen |

| 8074879 | December 2011 | Harris |

| 8078593 | December 2011 | Ramarao |

| 8082210 | December 2011 | Hansen |

| 8095113 | January 2012 | Kean |

| 8104679 | January 2012 | Brown |

| RE43157 | February 2012 | Bishop |

| 8109436 | February 2012 | Hopkins, III |

| 8121295 | February 2012 | Everson |

| 8121942 | February 2012 | Carlson |

| 8121956 | February 2012 | Carlson |

| 8126449 | February 2012 | Beenau |

| 8151345 | April 2012 | Yeager |

| 8171525 | May 2012 | Pelly |

| 8175973 | May 2012 | Davis et al. |

| 8190523 | May 2012 | Patterson |

| 8196813 | June 2012 | Vadhri |

| 8205791 | June 2012 | Randazza |

| 8219489 | July 2012 | Patterson |

| 8224702 | July 2012 | Mengerink |

| 8225385 | July 2012 | Chow |

| 8229852 | July 2012 | Carlson |

| 8265993 | September 2012 | Chien |

| 8280777 | October 2012 | Mengerink |

| 8281991 | October 2012 | Wentker et al. |

| 8307210 | November 2012 | Duane |

| 8328095 | December 2012 | Oder, II |

| 8336088 | December 2012 | Raj et al. |

| 8346666 | January 2013 | Lindelsee et al. |

| 8376225 | February 2013 | Hopkins, III |

| 8380177 | February 2013 | Laracey |

| 8387873 | March 2013 | Saunders |

| 8401539 | March 2013 | Beenau |

| 8401898 | March 2013 | Chien |

| 8402555 | March 2013 | Grecia |

| 8403211 | March 2013 | Brooks |

| 8412623 | April 2013 | Moon |

| 8412837 | April 2013 | Emigh |

| 8417642 | April 2013 | Oren |

| 8447699 | May 2013 | Batada |

| 8453223 | May 2013 | Svigals |

| 8453925 | June 2013 | Fisher |

| 8458487 | June 2013 | Palgon |

| 8484134 | July 2013 | Hobson |

| 8485437 | July 2013 | Mullen |

| 8494959 | July 2013 | Hathaway |

| 8498908 | July 2013 | Mengerink |

| 8504475 | August 2013 | Brand et al. |

| 8504478 | August 2013 | Saunders |

| 8510816 | August 2013 | Quach |

| 8433116 | September 2013 | Davis et al. |

| 8533860 | September 2013 | Grecia |

| 8538845 | September 2013 | Liberty |

| 8555079 | October 2013 | Shablygin |

| 8566168 | October 2013 | Bierbaum |

| 8567670 | October 2013 | Stanfield |

| 8571939 | October 2013 | Lindsey |

| 8577336 | November 2013 | Mechaley, Jr. |

| 8577803 | November 2013 | Chatterjee |

| 8577813 | November 2013 | Weiss |

| 8578176 | November 2013 | Mattsson |

| 8583494 | November 2013 | Fisher |

| 8584251 | November 2013 | Mcguire |

| 8589237 | November 2013 | Fisher |

| 8589271 | November 2013 | Evans |

| 8589291 | November 2013 | Carlson |

| 8595098 | November 2013 | Starai |

| 8595812 | November 2013 | Bomar |

| 8595850 | November 2013 | Spies |

| 8606638 | December 2013 | Dragt |

| 8606700 | December 2013 | Carlson |

| 8606720 | December 2013 | Baker |

| 8615468 | December 2013 | Varadarajan |

| 8620754 | December 2013 | Fisher |

| 8635157 | January 2014 | Smith |

| 8646059 | February 2014 | Von Behren |

| 8651374 | February 2014 | Brabson |

| 8656180 | February 2014 | Shablygin |

| 8751391 | June 2014 | Freund |

| 8762263 | June 2014 | Gauthier et al. |

| 8793186 | July 2014 | Patterson |

| 8838982 | September 2014 | Carlson et al. |

| 8856539 | October 2014 | Weiss |

| 8887308 | November 2014 | Grecia |

| 9065643 | June 2015 | Hurry et al. |

| 9070129 | June 2015 | Sheets et al. |

| 9100826 | August 2015 | Weiss |

| 9160741 | October 2015 | Wentker et al. |

| 9229964 | January 2016 | Stevelinck |

| 9245267 | January 2016 | Singh |

| 9249241 | February 2016 | Dai et al. |

| 9256871 | February 2016 | Anderson et al. |

| 9271110 | February 2016 | Fultz |

| 9280765 | March 2016 | Hammad |

| 9530137 | December 2016 | Weiss |

| 9860245 | January 2018 | Ronda |

| 9911117 | March 2018 | Everhart |

| 2001/0029485 | October 2001 | Brody |

| 2001/0034720 | October 2001 | Armes |

| 2001/0054003 | December 2001 | Chien |

| 2002/0007320 | January 2002 | Hogan |

| 2002/0016749 | February 2002 | Borecki |

| 2002/0029193 | March 2002 | Ranjan |

| 2002/0035548 | March 2002 | Hogan |

| 2002/0073045 | June 2002 | Rubin |

| 2002/0116341 | August 2002 | Hogan |

| 2002/0133467 | September 2002 | Hobson |

| 2002/0147913 | October 2002 | Lun Yip |

| 2002/0184511 | December 2002 | Kolouch |

| 2003/0028481 | February 2003 | Flitcroft |

| 2003/0084292 | May 2003 | Pierce |

| 2003/0130955 | July 2003 | Hawthorne |

| 2003/0191709 | October 2003 | Elston |

| 2003/0191945 | October 2003 | Keech |

| 2003/0212894 | November 2003 | Buck |

| 2004/0010462 | January 2004 | Moon |

| 2004/0034783 | February 2004 | Fedronic |

| 2004/0050928 | March 2004 | Bishop |

| 2004/0059682 | March 2004 | Hasumi |

| 2004/0093281 | May 2004 | Silverstein |

| 2004/0139008 | July 2004 | Mascavage |

| 2004/0143532 | July 2004 | Lee |

| 2004/0158532 | August 2004 | Breck |

| 2004/0210449 | October 2004 | Breck |

| 2004/0210498 | October 2004 | Freund |

| 2004/0232225 | November 2004 | Bishop |

| 2004/0260646 | December 2004 | Berardi |

| 2005/0037735 | February 2005 | Coutts |

| 2005/0069171 | March 2005 | Rhoads |

| 2005/0080730 | April 2005 | Sorrentino |

| 2005/0108178 | May 2005 | York |

| 2005/0137983 | June 2005 | Bells |

| 2005/0140964 | June 2005 | Eschenauer |

| 2005/0154923 | July 2005 | Lok |

| 2005/0166263 | July 2005 | Nanopoulos |

| 2005/0190914 | September 2005 | Chen |

| 2005/0199709 | September 2005 | Linlor |

| 2005/0246293 | November 2005 | Ong |

| 2005/0269401 | December 2005 | Spitzer |

| 2005/0269402 | December 2005 | Spitzer |

| 2005/0283441 | December 2005 | Ekberg |

| 2006/0075254 | April 2006 | Henniger |

| 2006/0235795 | October 2006 | Johnson |

| 2006/0237528 | October 2006 | Bishop |

| 2006/0255158 | November 2006 | Margalit |

| 2006/0278704 | December 2006 | Saunders |

| 2006/0287965 | December 2006 | Bajan |

| 2006/0288216 | December 2006 | Buhler |

| 2007/0066398 | March 2007 | Rowan |

| 2007/0067833 | March 2007 | Colnot |

| 2007/0107044 | May 2007 | Yuen |

| 2007/0129955 | June 2007 | Dalmia |

| 2007/0136193 | June 2007 | Starr |

| 2007/0136211 | June 2007 | Brown |

| 2007/0143227 | June 2007 | Kranzley |

| 2007/0150942 | June 2007 | Cartmell |

| 2007/0170247 | July 2007 | Friedman |

| 2007/0179885 | August 2007 | Bird |

| 2007/0208671 | September 2007 | Brown |

| 2007/0245414 | October 2007 | Chan |

| 2007/0262138 | November 2007 | Somers |

| 2007/0288377 | December 2007 | Shaked |

| 2007/0291995 | December 2007 | Rivera |

| 2008/0015988 | January 2008 | Brown |

| 2008/0029607 | February 2008 | Mullen |

| 2008/0035738 | February 2008 | Mullen |

| 2008/0052226 | February 2008 | Agarwal |

| 2008/0054068 | March 2008 | Mullen |

| 2008/0054079 | March 2008 | Mullen |

| 2008/0054081 | March 2008 | Mullen |

| 2008/0065554 | March 2008 | Hogan |

| 2008/0065555 | March 2008 | Mullen |

| 2008/0148057 | June 2008 | Hauw |

| 2008/0172738 | July 2008 | Bates |

| 2008/0201264 | August 2008 | Brown |

| 2008/0201265 | August 2008 | Hewton |

| 2008/0228646 | September 2008 | Myers |

| 2008/0243702 | October 2008 | Hart |

| 2008/0245855 | October 2008 | Fein |

| 2008/0245861 | October 2008 | Fein |

| 2008/0283591 | November 2008 | Oder, II |

| 2008/0302869 | December 2008 | Mullen |

| 2008/0302876 | December 2008 | Mullen |

| 2008/0313264 | December 2008 | Pestoni |

| 2009/0006262 | January 2009 | Brown |

| 2009/0010488 | January 2009 | Matsuoka |

| 2009/0037333 | February 2009 | Flitcroft |

| 2009/0037388 | February 2009 | Cooper |

| 2009/0043702 | February 2009 | Bennett |

| 2009/0048971 | February 2009 | Hathaway |

| 2009/0060184 | March 2009 | Alten |

| 2009/0106112 | April 2009 | Dalmia |

| 2009/0106160 | April 2009 | Skowronek |

| 2009/0134217 | May 2009 | Flitcroft |

| 2009/0157555 | June 2009 | Biffle |

| 2009/0159673 | June 2009 | Mullen |

| 2009/0159700 | June 2009 | Mullen |

| 2009/0159707 | June 2009 | Mullen |

| 2009/0173782 | July 2009 | Muscato |

| 2009/0200371 | August 2009 | Kean |

| 2009/0248583 | October 2009 | Chhabra |

| 2009/0276347 | November 2009 | Kargman |

| 2009/0281948 | November 2009 | Carlson |

| 2009/0294527 | December 2009 | Brabson |

| 2009/0307139 | December 2009 | Mardikar |

| 2009/0308921 | December 2009 | Mullen |

| 2009/0313318 | December 2009 | Dye |

| 2009/0327131 | December 2009 | Beenau |

| 2010/0008535 | January 2010 | Abulafia |

| 2010/0017867 | January 2010 | Fascenda |

| 2010/0024024 | January 2010 | Siourthas |

| 2010/0077216 | March 2010 | Kramer |

| 2010/0088237 | April 2010 | Wankmueller |

| 2010/0094755 | April 2010 | Kloster |

| 2010/0106644 | April 2010 | Annan |

| 2010/0120408 | May 2010 | Beenau |

| 2010/0133334 | June 2010 | Vadhri |

| 2010/0138347 | June 2010 | Chen |

| 2010/0145860 | June 2010 | Pelegero |

| 2010/0161433 | June 2010 | White |

| 2010/0185545 | July 2010 | Royyuru |

| 2010/0211505 | August 2010 | Saunders |

| 2010/0223186 | September 2010 | Hogan |

| 2010/0228668 | September 2010 | Hogan |

| 2010/0235284 | September 2010 | Moore |

| 2010/0258620 | October 2010 | Torreyson |

| 2010/0289627 | November 2010 | McAllister |

| 2010/0291904 | November 2010 | Musfeldt |

| 2010/0299267 | November 2010 | Faith et al. |

| 2010/0306076 | December 2010 | Taveau |

| 2010/0325041 | December 2010 | Berardi |

| 2011/0010292 | January 2011 | Giordano |

| 2011/0016047 | January 2011 | Wu |

| 2011/0016320 | January 2011 | Bergsten |

| 2011/0040640 | February 2011 | Erikson |

| 2011/0047076 | February 2011 | Carlson et al. |

| 2011/0083018 | April 2011 | Kesanupalli |

| 2011/0087596 | April 2011 | Dorsey |

| 2011/0093397 | April 2011 | Carlson |

| 2011/0103586 | May 2011 | Nobre |

| 2011/0125597 | May 2011 | Oder, II |

| 2011/0153437 | June 2011 | Archer |

| 2011/0153498 | June 2011 | Makhotin et al. |

| 2011/0154466 | June 2011 | Harper |

| 2011/0154467 | June 2011 | Bomar |

| 2011/0161233 | June 2011 | Tieken |

| 2011/0178926 | July 2011 | Lindelsee et al. |

| 2011/0191244 | August 2011 | Dai |

| 2011/0191592 | August 2011 | Goertzen |

| 2011/0197070 | August 2011 | Mizrah |

| 2011/0237224 | September 2011 | Coppinger |

| 2011/0238511 | September 2011 | Park |

| 2011/0238573 | September 2011 | Varadarajan |

| 2011/0246317 | October 2011 | Coppinger |

| 2011/0251892 | October 2011 | Laracey |

| 2011/0258111 | October 2011 | Raj et al. |

| 2011/0272471 | November 2011 | Mullen |

| 2011/0272478 | November 2011 | Mullen |

| 2011/0276380 | November 2011 | Mullen |

| 2011/0276381 | November 2011 | Mullen |

| 2011/0276424 | November 2011 | Mullen |

| 2011/0276425 | November 2011 | Mullen |

| 2011/0295745 | December 2011 | White |

| 2011/0302081 | December 2011 | Saunders |

| 2011/0307699 | December 2011 | Fielder |

| 2012/0023567 | January 2012 | Hammad |

| 2012/0028609 | February 2012 | Hruska |

| 2012/0030047 | February 2012 | Fuentes et al. |

| 2012/0035998 | February 2012 | Chien |

| 2012/0041881 | February 2012 | Basu |

| 2012/0047237 | February 2012 | Arvidsson |

| 2012/0060025 | March 2012 | Cahill |

| 2012/0066078 | March 2012 | Kingston |

| 2012/0072350 | March 2012 | Goldthwaite |

| 2012/0078735 | March 2012 | Bauer |

| 2012/0078798 | March 2012 | Downing |

| 2012/0078799 | March 2012 | Jackson |

| 2012/0095852 | April 2012 | Bauer |

| 2012/0095865 | April 2012 | Doherty |

| 2012/0110318 | May 2012 | Stone |

| 2012/0116902 | May 2012 | Cardina |

| 2012/0123882 | May 2012 | Carlson |

| 2012/0123940 | May 2012 | Killian |

| 2012/0129514 | May 2012 | Beenau |

| 2012/0143767 | June 2012 | Abadir |

| 2012/0143772 | June 2012 | Abadir |

| 2012/0158580 | June 2012 | Eram |

| 2012/0158593 | June 2012 | Garfinkle |

| 2012/0173431 | July 2012 | Ritchie |

| 2012/0179952 | July 2012 | Tuyls |

| 2012/0185386 | July 2012 | Salama |

| 2012/0197807 | August 2012 | Schlesser |

| 2012/0203664 | August 2012 | Torossian |

| 2012/0203666 | August 2012 | Torossian |

| 2012/0203700 | August 2012 | Ornce |

| 2012/0215688 | August 2012 | Musser |

| 2012/0215696 | August 2012 | Salonen |

| 2012/0221421 | August 2012 | Hammad |

| 2012/0221859 | August 2012 | Marien |

| 2012/0226582 | September 2012 | Hammad |

| 2012/0231844 | September 2012 | Coppinger |

| 2012/0233004 | September 2012 | Bercaw |

| 2012/0246070 | September 2012 | Vadhri |

| 2012/0246071 | September 2012 | Jain |

| 2012/0246079 | September 2012 | Wilson et al. |

| 2012/0265631 | October 2012 | Cronic |

| 2012/0271770 | October 2012 | Harris |

| 2012/0297446 | November 2012 | Webb |

| 2012/0300932 | November 2012 | Cambridge |

| 2012/0303503 | November 2012 | Cambridge |

| 2012/0303961 | November 2012 | Kean |

| 2012/0304273 | November 2012 | Bailey |

| 2012/0310725 | December 2012 | Chien |

| 2012/0310831 | December 2012 | Harris |

| 2012/0316992 | December 2012 | Oborne |

| 2012/0317035 | December 2012 | Royyuru |

| 2012/0317036 | December 2012 | Bower |

| 2013/0017784 | January 2013 | Fisher |

| 2013/0018757 | January 2013 | Anderson et al. |

| 2013/0019098 | January 2013 | Gupta |

| 2013/0031006 | January 2013 | Mccullagh et al. |

| 2013/0047263 | February 2013 | Radhakrishnan |

| 2013/0054337 | February 2013 | Brendell |

| 2013/0054466 | February 2013 | Muscato |

| 2013/0054474 | February 2013 | Yeager |

| 2013/0081122 | March 2013 | Svigals |

| 2013/0085944 | April 2013 | Fielder |

| 2013/0091028 | April 2013 | Oder, II |

| 2013/0110658 | May 2013 | Lyman |

| 2013/0111599 | May 2013 | Gargiulo |

| 2013/0117185 | May 2013 | Collison |

| 2013/0124290 | May 2013 | Fisher |

| 2013/0124291 | May 2013 | Fisher |

| 2013/0124364 | May 2013 | Mittal |

| 2013/0138525 | May 2013 | Bercaw |

| 2013/0144888 | June 2013 | Faith |

| 2013/0145148 | June 2013 | Shablygin |

| 2013/0145172 | June 2013 | Shablygin |

| 2013/0159178 | June 2013 | Colon |

| 2013/0159184 | June 2013 | Thaw |

| 2013/0159195 | June 2013 | Kirillin |

| 2013/0166402 | June 2013 | Parento |

| 2013/0166456 | June 2013 | Zhang |

| 2013/0173736 | July 2013 | Krzeminski |

| 2013/0185202 | July 2013 | Goldthwaite |

| 2013/0191286 | July 2013 | Cronic |

| 2013/0191289 | July 2013 | Cronic |

| 2013/0198071 | August 2013 | Jurss |

| 2013/0198080 | August 2013 | Anderson et al. |

| 2013/0200146 | August 2013 | Moghadam |

| 2013/0204787 | August 2013 | Dubois |

| 2013/0204793 | August 2013 | Kerridge |

| 2013/0212007 | August 2013 | Mattsson |

| 2013/0212017 | August 2013 | Bangia |

| 2013/0212019 | August 2013 | Mattsson |

| 2013/0212024 | August 2013 | Mattsson |

| 2013/0212026 | August 2013 | Powell et al. |

| 2013/0212666 | August 2013 | Mattsson |

| 2013/0218698 | August 2013 | Moon |

| 2013/0218769 | August 2013 | Pourfallah et al. |

| 2013/0226799 | August 2013 | Raj |

| 2013/0226813 | August 2013 | Voltz |

| 2013/0226815 | August 2013 | Ibasco |

| 2013/0246199 | September 2013 | Carlson |

| 2013/0246202 | September 2013 | Tobin |

| 2013/0246203 | September 2013 | Laracey |

| 2013/0246258 | September 2013 | Dessert |

| 2013/0246259 | September 2013 | Dessert |

| 2013/0246261 | September 2013 | Purves et al. |

| 2013/0246267 | September 2013 | Tobin |

| 2013/0254028 | September 2013 | Salci |

| 2013/0254052 | September 2013 | Royyuru |

| 2013/0254102 | September 2013 | Royyuru |

| 2013/0254117 | September 2013 | Von Mueller |

| 2013/0262296 | October 2013 | Thomas |

| 2013/0262302 | October 2013 | Lettow |

| 2013/0262315 | October 2013 | Hruska |

| 2013/0262316 | October 2013 | Hruska |

| 2013/0262317 | October 2013 | Collinge |

| 2013/0275300 | October 2013 | Killian |

| 2013/0275307 | October 2013 | Khan |

| 2013/0275308 | October 2013 | Paraskeva |

| 2013/0282502 | October 2013 | Jooste |

| 2013/0282575 | October 2013 | Mullen |

| 2013/0282588 | October 2013 | Hruska |

| 2013/0290719 | October 2013 | Kaler |

| 2013/0297501 | November 2013 | Monk et al. |

| 2013/0297504 | November 2013 | Nwokolo |

| 2013/0297508 | November 2013 | Belamant |

| 2013/0304649 | November 2013 | Cronic |

| 2013/0308778 | November 2013 | Fosmark |

| 2013/0311382 | November 2013 | Fosmark |

| 2013/0317982 | November 2013 | Mengerink |

| 2013/0326602 | December 2013 | Chen |

| 2013/0332344 | December 2013 | Weber |

| 2013/0339253 | December 2013 | Sincai |

| 2013/0346314 | December 2013 | Mogollon |

| 2014/0004817 | January 2014 | Horton |

| 2014/0007213 | January 2014 | Sanin |

| 2014/0013106 | January 2014 | Redpath |

| 2014/0013114 | January 2014 | Redpath |

| 2014/0013452 | January 2014 | Aissi et al. |

| 2014/0019352 | January 2014 | Shrivastava |

| 2014/0019364 | January 2014 | Hurry |

| 2014/0019752 | January 2014 | Yin |

| 2014/0025581 | January 2014 | Calman |

| 2014/0025585 | January 2014 | Calman |

| 2014/0025958 | January 2014 | Calman |

| 2014/0032417 | January 2014 | Mattsson |

| 2014/0032418 | January 2014 | Weber |

| 2014/0040137 | February 2014 | Carlson |

| 2014/0040139 | February 2014 | Brudnicki |

| 2014/0040144 | February 2014 | Plomske |

| 2014/0040145 | February 2014 | Ozvat |

| 2014/0040148 | February 2014 | Ozvat |

| 2014/0040628 | February 2014 | Fort |

| 2014/0041018 | February 2014 | Bomar |

| 2014/0046853 | February 2014 | Spies |

| 2014/0047551 | February 2014 | Nagasundaram et al. |

| 2014/0052532 | February 2014 | Tsai |

| 2014/0052620 | February 2014 | Rogers |

| 2014/0052637 | February 2014 | Jooste |

| 2014/0068706 | March 2014 | Aissi |

| 2014/0074637 | March 2014 | Hammad |

| 2014/0082366 | March 2014 | Engler |

| 2014/0108172 | April 2014 | Weber et al. |

| 2014/0114857 | April 2014 | Griggs et al. |

| 2014/0136418 | May 2014 | Fielder |

| 2014/0143137 | May 2014 | Carlson |

| 2014/0164243 | June 2014 | Aabye et al. |

| 2014/0188586 | July 2014 | Carpenter et al. |

| 2014/0294701 | October 2014 | Dai et al. |

| 2014/0297534 | October 2014 | Patterson |

| 2014/0310183 | October 2014 | Weber |

| 2014/0330721 | November 2014 | Wang |

| 2014/0330722 | November 2014 | Laxminarayanan et al. |

| 2014/0331265 | November 2014 | Mozell et al. |

| 2014/0337236 | November 2014 | Wong et al. |

| 2014/0344153 | November 2014 | Raj et al. |

| 2014/0372308 | December 2014 | Sheets |

| 2015/0019443 | January 2015 | Sheets et al. |

| 2015/0032625 | January 2015 | Dill |

| 2015/0032626 | January 2015 | Dill |

| 2015/0032627 | January 2015 | Dill |

| 2015/0046338 | February 2015 | Laxminarayanan |

| 2015/0046339 | February 2015 | Wong et al. |

| 2015/0052064 | February 2015 | Karpenko et al. |

| 2015/0088756 | March 2015 | Makhotin et al. |

| 2015/0106239 | April 2015 | Gaddam et al. |

| 2015/0112870 | April 2015 | Nagasundaram et al. |

| 2015/0112871 | April 2015 | Kumnick |

| 2015/0120472 | April 2015 | Aabye et al. |

| 2015/0127529 | May 2015 | Makhotin et al. |

| 2015/0127547 | May 2015 | Powell et al. |

| 2015/0128243 | May 2015 | Roux |

| 2015/0140960 | May 2015 | Powell et al. |

| 2015/0142673 | May 2015 | Nelsen et al. |

| 2015/0161597 | June 2015 | Subramanian et al. |

| 2015/0178724 | June 2015 | Ngo et al. |

| 2015/0180836 | June 2015 | Wong et al. |

| 2015/0186864 | July 2015 | Jones et al. |

| 2015/0193222 | July 2015 | Pirzadeh et al. |

| 2015/0195133 | July 2015 | Sheets et al. |

| 2015/0199679 | July 2015 | Palanisamy et al. |

| 2015/0199689 | July 2015 | Kumnick et al. |

| 2015/0220917 | August 2015 | Aabye et al. |

| 2015/0269566 | September 2015 | Gaddam et al. |

| 2015/0312038 | October 2015 | Palanisamy |

| 2015/0319158 | November 2015 | Kumnick |

| 2015/0332262 | November 2015 | Lingappa |

| 2015/0356560 | December 2015 | Shastry et al. |

| 2016/0028550 | January 2016 | Gaddam et al. |

| 2016/0042263 | February 2016 | Gaddam et al. |

| 2016/0065370 | March 2016 | Le Saint et al. |

| 2016/0092696 | March 2016 | Guglani et al. |

| 2016/0092872 | March 2016 | Prakash et al. |

| 2016/0103675 | April 2016 | Aabye et al. |

| 2016/0119296 | April 2016 | Laxminarayanan et al. |

| 2016/0224976 | August 2016 | Basu |

| 2017/0046696 | February 2017 | Powell et al. |

| 2017/0103387 | April 2017 | Weber |

| 2017/0220818 | August 2017 | Nagasundaram et al. |

| 2017/0228723 | August 2017 | Taylor |

| 2156397 | Feb 2010 | EP | |||

| 2001035304 | May 2001 | WO | |||

| 2001035304 | May 2001 | WO | |||

| 2004042536 | May 2004 | WO | |||

| 2006113834 | Oct 2006 | WO | |||

| 2009032523 | Mar 2009 | WO | |||

| 2010078522 | Jul 2010 | WO | |||

| 2012068078 | May 2012 | WO | |||

| WO2012064280 | May 2012 | WO | |||

| 2012098556 | Jul 2012 | WO | |||

| 2012142370 | Oct 2012 | WO | |||

| 2012167941 | Dec 2012 | WO | |||

| 2013048538 | Apr 2013 | WO | |||

| 2013056104 | Apr 2013 | WO | |||

| 2013119914 | Aug 2013 | WO | |||

| 2013179271 | Dec 2013 | WO | |||

Other References

|

Petition for Inter Partes Review of U.S. Pat. No. 8,533,860 Challenging Claims 1-30 Under 35 U.S.C. .sctn. 312 and 37 C.F.R. .sctn. 42.104, filed Feb. 17, 2016, Before the USPTO Patent Trial and Appeal Board, IPR 2016-00600, 65 pages. cited by applicant . Wang, U.S. Appl. No. 62/000,288 (unpublished), Payment System Canonical Address Format filed May 19, 2014. cited by applicant . Sharma et al., U.S. Appl. No. 62/003,717 (unpublished), Mobile Merchant Application filed May 28, 2014. cited by applicant . Kalgi et al., U.S. Appl. No. 62/024,426, (unpublished) Secure Transactions Using Mobile Devices filed Jul. 14, 2014. cited by applicant . Prakash et al., U.S. Appl. No. 62/037,033 (unpublished), Sharing Payment Token filed Aug. 13, 2014. cited by applicant . Hoverson et al., U.S. Appl. No. 62/038,174 (unpublished), Customized Payment Gateway filed Aug. 15, 2014. cited by applicant . Wang, U.S. Appl. No. 62/042,050 (unpublished), Payment Device Authentication and Authorization System filed Aug. 26, 2014. cited by applicant . Gaddam et al., U.S. Appl. No. 62/053,736 (unpublished), Completing Transactions Without a User Payment Device filed Sep. 22, 2014. cited by applicant . Patterson, U.S. Appl. No. 62/054,346 (unpublished), Mirrored Token Vault filed Sep. 23, 2014. cited by applicant . Dimmick, U.S. Appl. No. 14/952,514 (unpublished), Systems Communications With Non-Sensitive Identifiers filed Nov. 25, 2015. cited by applicant . Dimmick, U.S. Appl. No. 14/952,444 (unpublished), Tokenization Request Via Access Device filed Nov. 25, 2015. cited by applicant . Prakash et al., U.S. Appl. No. 14/955,716 (unpublished), Provisioning Platform for Machine-To-Machine Devices filed Dec. 1, 2015. cited by applicant . Wong et al., U.S. Appl. No. 14/966,948 (unpublished), Automated Access Data Provisioning filed Dec. 11, 2015. cited by applicant . Stubbs et al., U.S. Appl. No. 62/103,522 (unpublished), Methods and Systems for Wallet Provider Provisioning filed Jan. 14, 2015. cited by applicant . McGuire, U.S. Appl. No. 14/600,523 (unpublished), Secure Payment Processing Using Authorization Request filed Jan. 20, 2015. cited by applicant . Flurscheim et al., U.S. Appl. No. 15/004,705 (unpublished), Cloud-Based Transactions With Magnetic Secure Transmission filed Jan. 22, 2016. cited by applicant . Flurscheim et al., U.S. Appl. No. 62/108,403 (unpublished), Wearables With NFC HCE filed Jan. 27, 2015. cited by applicant . Sabba et al., U.S. Appl. No. 15/011,366 (unpublished), Token Check Offline filed Jan. 29, 2016. cited by applicant . Patterson, U.S. Appl. No. 15/019,157 (unpublished), Token Processing Utilizing Multiple Authorizations filed Feb. 9, 2016. cited by applicant . Cash et al., U.S. Appl. No. 15/041,495 (unpublished), Peer Forward Authorization of Digital Requests filed Feb. 11, 2016. cited by applicant . Le Saint et al., , U.S. Appl. No. 15/008,388 (unpublished), Methods for Secure Credential Provisioning filed Jan. 27, 2016. cited by applicant . Kinagi, U.S. Appl. No. 62/117,291 (unpublished), Token and Cryptogram Using Transaction Specific Information filed Feb. 17, 2015. cited by applicant . Galland et al. U.S. Appl. No. 62/128,709 (unpublished), Tokenizing Transaction Amounts filed Mar. 5, 2015. cited by applicant . Rangarajan et al., U.S. Appl. No. 61/751,763 (unpublished), Payments Bridge filed Jan. 11, 2013. cited by applicant . Li, U.S. Appl. No. 61/894,749 (unpublished), Methods and Systems for Authentication and Issuance of Tokens in a Secure Environment filed Oct. 23, 2013. cited by applicant . Aissi et al., U.S. Appl. No. 61/738,832 (unpublished), Management of Sensitive Data filed Dec. 18, 2012. cited by applicant . Wong et al., U.S. Appl. No. 61/879,362 (unpublished), Systems and Methods for Managing Mobile Cardholder Verification Methods filed Sep. 18, 2013. cited by applicant . Powell, U.S. Appl. No. 61/892,407 (unpublished), Issuer Over-The-Air Update Method and System filed Oct. 17, 2013. cited by applicant . Powell, U.S. Appl. No. 61/926,236 (unpublished), Methods and Systems for Provisioning Mobile Devices With Payment Credentials and Payment Token Identifiers filed Jan. 10, 2014. cited by applicant . International Search Report dated Apr. 1, 2014 in PCT/IB2013/060696, 3 pages. cited by applicant . Chipman, et al., U.S. Appl. No. 15/265,282 (Unpublished), Self-Cleaning Token Vault, filed Sep. 14, 2016. cited by applicant . Lopez, et al., U.S. Appl. No. 15/462,658 (Unpublished), Replacing Token on a Multi-Token User Device, filed Mar. 17, 2017. cited by applicant. |

Primary Examiner: Chang; Edward

Assistant Examiner: Smith; Slade E

Attorney, Agent or Firm: Kilpatrick Townsend & Stockton LLP

Claims

What is claimed is:

1. A method for providing financial details from a mobile device of a user for use in a transaction, the method being performed on the mobile device of the user and including the steps of: generating, on a token generating component associated with the mobile device, a session-specific token by applying an algorithm stored on the token generating component with a dynamic key, the session-specific token generated by encrypting a customer identification number using the dynamic key and a seed value unique to the user; retrieving, by the mobile device, financial details in a pre-determined format conforming to Track 2 data format for use in a transaction; incorporating the session-specific token and the financial details into a modified form of the financial details including encrypting a portion of characters of the financial details using the session-specific token by incorporating a first portion of the session-specific token before a check digit of the financial details, incorporating a second portion of the session-specific token before a CVV field of the financial details, and replacing data in an account number field with the customer identification number; and transferring the modified form of the financial details in the predetermined format from the mobile device to an issuing authority to initiate the transaction, the issuing authority validating the session-specific token within the modified form of the financial details before authorizing the transaction.

2. The method as claimed in claim 1, wherein incorporating the session-specific token and the financial details into a modified form of the financial details includes: inserting the session-specific token into redundant characters in the pre-determined format.

3. The method as claimed in claim 1, wherein the seed value unique to the user is provided by the issuing authority to the mobile device.

4. The method as claimed in claim 1, wherein the seed value unique to the user is used by the issuing authority to generate an expected session-specific token, the expected session-specific token being compared to the session-specific token when validating the session-specific token.

5. The method as claimed in claim 1, wherein the session-specific token offline from an is generated while not in communication with the issuing authority and the dynamic key is coordinated between the mobile device and the issuing authority.

6. The method as claimed in claim 5, wherein the dynamic key and one of a customer identifier or an initialization vector for a customer is used by an issuing authority to generate an expected-session-specific token to be compared to the session-specific token to authenticate the user.

7. The method as claimed in claim 1, wherein the financial details include static customer account details or one-time generated customer account details.

8. The method as claimed in claim 1, wherein the dynamic key is randomly selected from a pre-calculated set of keys; and a key serial number related to the dynamic key is transferred along with the modified form of the financial details, wherein the key serial number is able to be used to determine the dynamic key that was used.

9. The method as claimed in claim 1, wherein the dynamic key is a counter value which increments or changes every time the algorithm is applied.

10. The method as claimed in claim 1, wherein the dynamic key is based on a time signal derived by the mobile device, the time signal indicating a time at which the generation of the session-specific token is carried out.

11. The method as claimed in claim 1, wherein the token generating component is a cryptographic expansion device that can be attached to a communication component of the mobile device; and the cryptographic expansion device is configured to be used with the mobile device without requiring any changes to the internal software or hardware of the mobile device and without requiring any modification to the communication protocols used by the mobile device.

12. The method as claimed in claim 1, wherein the token generating component is a hardware security module which uses hardware to generate the session-specific token.

13. The method as claimed in claim 1, wherein validating the session-specific token by the issuing authority comprises: identifying, by the issuing authority, the seed value unique to the user based on the customer identification number; determining a lifetime of the session-specific token; generating a plurality of expected session-specific tokens based on the lifetime of the session-specific token; and comparing the session-specific token to each of the expected session-specific tokens of the plurality of expected session-specific tokens, the session-specific token being validated upon determining that the session-specific token matches one expected session-specific token of the plurality of expected session-specific tokens.

14. The method as claimed in claim 13, wherein the lifetime of the session-specific token is ten minutes and the plurality of expected session-specific tokens comprises ten expected session-specific tokens, wherein each of the plurality of expected session-specific tokens is generated to correspond to a one-minute interval of the lifetime.

15. The method as claimed in claim 1, wherein the session-specific token comprises six digits, the first portion of the session-specific token comprises a first three digits of the session-specific token, and the second portion of the session-specific token comprises a last three digits of the session-specific token.

16. A system for providing financial details from a mobile device of a user for use in a transaction, the system being provided on the mobile device of the user and including: a token generating component associated with the mobile device for generating a session-specific token by applying an algorithm stored on the token generating component with a dynamic key, the session-specific token generated by encrypting a customer identification number using the dynamic key and a seed value unique to the user; a financial details component for providing financial details in a pre-determined format conforming to Track 2 data format for use in a transaction; a format modifying component for incorporating the session-specific token and the financial details into a modified form of the financial details including encrypting a portion of characters of the financial details with the session-specific token by incorporating a first portion of the session-specific token before a check digit of the financial details, incorporating a second portion of the session-specific token before a CVV field of the financial details, and replacing data in an account number field with the customer identification number; and a communication component for transferring the modified form of the financial details in the pre-determined format from the mobile device to an issuing authority to initiate the transaction, the issuing authority being caused to validate the session-specific token within the modified form of the financial details before authorizing the transaction.

17. The system as claimed in claim 16, wherein the token generating component is a cryptographic expansion device that can be attached to a communication component of the mobile device; and the cryptographic expansion device is configured to be used with the mobile device without requiring any changes to the internal software or hardware of the mobile device and without requiring any modification to the communication protocols used by the mobile device.

18. The system as claimed in claim 17, wherein the cryptographic expansion device is a cryptographic label that includes a hardware security module (HSM) disposed therein including a secure processing unit and a public processing unit.

19. The system as claimed in claim 16, wherein the token generating component is a hardware security module which uses hardware to generate the session-specific token.

20. A computer program product for providing financial details from a mobile device of a user for use in a transaction, the computer program product comprising a computer-readable medium having stored computer-readable program code for performing the steps of: generating, on a token generating component associated with the mobile device, a session-specific token by applying an algorithm stored on the token generating component with a dynamic key, the session-specific token generated by encrypting a customer identification number using the dynamic key and a seed value unique to the user; providing financial details in a pre-determined format conforming to Track 2 data format for use in a transaction; incorporating the session-specific token and the financial details into a modified form of the financial details including encrypting a portion of characters of the financial details with the session-specific token by incorporating a first portion of the session-specific token before a check digit of the financial details, incorporating a second portion of the session-specific token before a CVV field of the financial details, and replacing data in an account number field with the customer identification number; and transferring the modified form of the financial details in the predetermined format from the mobile device to an issuing authority to initiate the transaction, the issuing authority validating the session-specific token within the modified form of the financial details before authorizing the transaction.

Description

CROSS-REFERENCES TO RELATED APPLICATIONS

This application is a National Stage of International Application No. PCT/IB2013/060696, International Filing Date Dec. 6, 2013, and which claims the benefit of South African Patent Application No. 2012/09284, filed Dec. 7, 2012, the disclosures of both applications being incorporated herein by reference.

BACKGROUND

This invention relates to a device, system and method for generating tokens for security purposes.

Many applications utilize token generation to enhance security through the provision of session specific tokens. Token generators often require a user to carry hardware with them, such as key fobs, cards, or USB devices, which are required for the generation of the session specific token. Carrying such devices may be inconvenient to a user.

The abovementioned hardware-type token generators often use time-based encryption, wherein the current time upon generation of a session-specific token is used as an input value to the algorithm used. The use of a time as an input value is an example of dynamic key use, where a continuously changing (dynamic) key is used as an input value to the algorithm used for determining the session specific token. A dynamic key ensures that the algorithm will provide a different result each time that the result of the algorithm is determined. If the same input value is used more than once in a token generating device which utilizes a single algorithm, the same result will be obtained. By including a dynamic input value, a different result should be obtained after each calculation.

A major problem which is often encountered with hardware-type token generators which use time as an input value is that the clock which provides the time to the hardware has to be synchronized with the clock of a service provider who has to check the validity of a generated token. Should the clocks not be synchronized, a validly generated token may not be recognized as valid when it is checked by a service provider with a clock that is out-of-sync to the clock of the hardware.

Mobile banking involves the use of a mobile device to pay for goods or services at a point-of-sale (POS) of a merchant, or even remotely. Mobile payments, in turn, refer to payment services performed with the use of a mobile device. Examples of mobile payments include situations in which details of a person's financial transaction card, such as a debit or credit card, is stored on the person's mobile device, typically in the format of Track 1 or Track 2 card data. Track 1 and Track 2 are standardized formats in which properties of a financial transaction card are stored on the cards themselves.

The mobile device transfers the details of a person's financial transaction card to a POS terminal of a merchant where a user wishes to transact, for example by means of near-field communications technology. The POS terminal, in turn, transmits the details to an issuing authority that is to approve or deny payment from an account of the user held by the issuing authority. Security concerns do however still exist with regards to mobile payments, for example regarding the possibility of the interception of the details during its transfer, or the access protection offered by the mobile device with regards to the payments cards stored thereon.

BRIEF SUMMARY

In accordance with an embodiment of the invention there is provided a method for providing financial details from a mobile device of a user for use in a transaction, the method being performed on a mobile device of the user and including the steps of:

generating, on a token generating component associated with the mobile device, a session-specific token by applying an algorithm stored on the token generating component with a dynamic key;

providing financial details in a pre-determined format for use in a transaction;

incorporating the session-specific token and the financial details into a modified form of the financial details; and

transferring the modified form of the financial details in the pre-determined format from the mobile device to initiate the transaction.

Further features of the invention provide for the step of incorporating the session-specific token and the financial details into a modified form of the financial details to include inserting the session-specific token into redundant characters in the pre-determined format; and to include encrypting a portion of the characters of the financial details with the session-specific token.

Still further features of the invention provide for the algorithm stored on the token generating component to include an individual seed value for a customer; and for the modified form of the financial details to include a readable customer identifier.

Yet further features of the invention provide for the algorithm stored on the token generating component to include a seed value for an issuing authority; and for the modified form of the financial details to include a readable issuing authority identifier and an initiation vector.

In one embodiment of the invention, the dynamic key acts as the seed value. In a further embodiment, the user has a unique seed value, and the issuing authority has a database storing details relating to customer's respective unique seed values.

Further features of the invention provide for the step of generating, on a token generating component associated with the mobile device, a session-specific token by applying an algorithm stored on the token generating component with a dynamic key, generates the session-specific token offline from an issuing authority and the dynamic key is coordinated between the mobile device and the issuing authority.

A still further feature of the invention provides for the session-specific token to be generated without a communication channel to a issuing authority that is to verify the validity of the token, the issuing authority able to determine the session-specific token used, and its validity.

A yet further feature of the invention provides for the dynamic key and one of a customer identifier or an initialization vector for a customer to enable the session-specific token to be reversed by an issuing authority to authenticate a customer.

A further feature of the invention provides for the financial details to include static customer account details or one-time generated customer account details.

Still further features of the invention provide for the dynamic key to be randomly selected from a pre-calculated set of keys; and for a key serial number related to the dynamic key to be transferred along with the modified form of the financial details, wherein the key serial number is able to determine the dynamic key that was used.

Yet further features of the invention provide for the dynamic key to be a counter value which increments or changes every time the algorithm is applied; or to be a based on a time signal derived by the mobile device and at which the generation of the session-specific token is carried out.

Still further features of the invention provide for the session-specific token to be inserted in redundant characters in the pre-determined format; for the format to be compatible with a POS terminal; for the format to be the Track 1 or Track 2 data format of a financial transaction card; and for the session-specific token to be inserted at least partially in any one or more of a field normally reserved for an expiration date, a card security code, a service code, discretionary data, or a name. In one embodiment of the invention, the token is inserted into the card security code only, and the card security code can be described as a dynamic card security code.

In one embodiment of the invention, the financial details are transferred to a point-of-sale (POS) terminal of a merchant, from where it is further transferred to the issuing authority.

Further features of the invention provide for the token generating component to be a cryptographic expansion device that can be attached to a communication component of the mobile device; and for the cryptographic expansion device to be configured to be used with the mobile device without requiring any changes to the internal software or hardware of the mobile device and without requiring any modification to the communication protocols used by the mobile device.

The invention further extends to the cryptographic expansion device being a cryptographic label that includes a hardware security module (HSM) disposed therein including a secure processing unit and a public processing unit.

In one embodiment of the invention, the cryptographic label also includes a first set of electrical contacts disposed on the top side of the cryptographic label for interfacing to a mobile device, and a second set of electrical contacts disposed on the bottom side of the cryptographic label for interfacing to a communication component. A coupling element may also be provided to attach the cryptographic label to the communication component. In an exemplary embodiment, the mobile device can be a mobile phone, the communication component can be a subscriber identity module (SIM) card, and the coupling element used for attaching the cryptographic label to the communication component can be an adhesive material disposed on the cryptographic label.

The invention extends to a method for determining the validity of financial details, the method being performed at a server and including the steps of:

receiving a pre-determined format of financial details for a transaction;

extracting a session-specific token from the pre-determined format;

generating, on a token generating component associated with the server, at least one expected session-specific token by applying an algorithm with a dynamic key;

comparing the at least one expected session-specific token and the extracted session-specific token; and

in response to the extracted session-specific token matching at least one expected session-specific token, approving the received financial details for use; or,

in response to the extracted session-specific token matching none of the at least one expected session-specific tokens, rejecting the financial details for use.

A further feature of the invention provides for the step of extracting the session-specific token from the pre-determined format to include extracting the session-specific token from redundant characters in the pre-determined format.

Still further features of the invention provide for the algorithm stored on the token generating component to include an individual seed value for a customer; and for the received pre-determined format of financial details to include a readable customer identifier.

Yet further features of the invention provide for the algorithm stored on the token generating component to include a seed value for an issuing authority; and for the received pre-determined format of financial details to include a readable issuing authority identifier and an initialization vector.

Further features of the invention provide for the financial details to include static customer account details or one-time generated customer account details. In one embodiment, the pre-determined format may be a Track 1 or Track 2 data format of a financial transaction card.

Still further features of the invention provides for the financial details to include a serial number related to the dynamic key, the serial number providing an indication of the dynamic key used; the server having a database associated therewith which stores a list of keys and related serial numbers.

Yet further features of the invention provides for the server to be a server of an issuing authority at which a user has an account; and for financial details to be received from the mobile device of a user or a POS terminal of a merchant.

Further features of the invention provide for an expected session-specific token to be any token which may have been validly generated within a pre-determined amount of time; or to be any token which may have been validly generated a pre-determined amount of times since a previous transaction approval message has been transmitted.

A still further feature of the invention provides for the method to include the step of transmitting a transaction approval or a transaction rejection message to an electronic device of either the user or the merchant in response to the approval or rejection of the financial details for use.

The invention extends to a system for providing financial details from a mobile device of a user for use in a transaction, the system being provided on a mobile device of the user and including:

a token generating component associated with the mobile device for generating a session-specific token by applying an algorithm stored on the token generating component with a dynamic key;

a financial details component for providing financial details in a pre-determined format for use in a transaction

a format modifying component for incorporating the session-specific token and the financial details into a modified form of the financial details; and

a communication component for transferring the modified form of the financial details in the pre-determined format from the mobile device to initiate the transaction.

Further features of the invention provide for the format modifying component to incorporate the session-specific token and the financial details into a modified form of the financial details by inserting the session-specific token into redundant characters in the pre-determined format; or by encrypting a portion of the characters of the financial details with the session-specific token.

In one embodiment of the invention, the algorithm stored on the token generating component may include an individual seed value for a customer; and wherein the modified form of the financial details may include a readable customer identifier. In another embodiment, the algorithm stored on the token generating component may include a seed value for an issuing authority; and wherein the modified form of the financial details may include a readable issuing authority identifier and an initialization vector.

In one embodiment of the invention, the modified form of the financial details is transferred to a point-of-sale (POS) terminal of a merchant, from where it is further transferred to the issuing authority.

The invention extends to a mobile device having a hardware security module having a memory component for storing at least an algorithm, a seed value and a pre-determined format; and the token generating component applying the algorithm with input values including at least the seed value and a dynamic key.

Further features of the invention provide for the token generating component to be a cryptographic expansion device that can be attached to a communication component of the mobile device; and for the cryptographic expansion device to be configured to be used with the mobile device without requiring any changes to the internal software or hardware of the mobile device and without requiring any modification to the communication protocols used by the mobile device.

A still further feature of the invention provide for the cryptographic expansion device to be a cryptographic label that includes a hardware security module (HSM) disposed therein including a secure processing unit and a public processing unit.

In one embodiment of the invention, the cryptographic label also includes a first set of electrical contacts disposed on the top side of the cryptographic label for interfacing to a mobile device, and a second set of electrical contacts disposed on the bottom side of the cryptographic label for interfacing to a communication component. A coupling element may also be provided to attach the cryptographic label to the communication component. In an exemplary embodiment, the mobile device can be a mobile phone, the communication component can be a subscriber identity module (SIM) card, and the coupling element used for attaching the cryptographic label to the communication component can be an adhesive material disposed on the cryptographic label.

The invention extends to a system for determining the validity of financial details, the system being provided at a server and including:

a receiving component for receiving a pre-determined format of financial details for a transaction;

an extracting component for extracting a session-specific token from the pre-determined format;

a token generating component associated with the server for generating at least one expected session-specific token by applying an algorithm with a dynamic key;

a comparing component for comparing the at least one expected session-specific token and the extracted session-specific token; and

in response to the extracted session-specific token matching at least one expected session-specific token, approving the received financial details for use; or,

in response to the extracted session-specific token matching none of the at least one expected session-specific tokens, rejecting the financial details for use.

Further features of the invention provides for the server to be a server of an issuing authority at which a user has an account; and for financial details to be received from a POS terminal of a merchant.

A yet further feature of the invention provides for the system to include a transmission component for transmitting a transaction approval or a transaction rejection message to an electronic device of either the user or the merchant in response to the approval or rejection of the financial details for use.

The invention extends to a computer program product for providing financial details from a mobile device of a user for use in a transaction, the computer program product comprising a computer-readable medium having stored computer-readable program code for performing the steps of:

generating, on a token generating component associated with the mobile device, a session-specific token by applying an algorithm stored on the token generating component with a dynamic key;

providing financial details in a pre-determined format for use in a transaction;

incorporating the session-specific token and the financial details into a modified form of the financial details; and

transferring the modified form of the financial details in the pre-determined format from the mobile device to initiate the transaction.

The invention further extends to a computer program product for determining the validity of financial details, the computer program product comprising a computer-readable medium having stored computer-readable program code for performing the steps of:

receiving a pre-determined format of financial details for a transaction;

extracting a session-specific token from the pre-determined format;

generating, on a token generating component associated with the server, at least one expected session-specific token by applying an algorithm with a dynamic key;

comparing the at least one expected session-specific token and the extracted session-specific token; and

in response to the extracted session-specific token matching at least one expected session-specific token, approving the received financial details for use; or,

in response to the extracted session-specific token matching none of the at least one expected session-specific tokens, rejecting the financial details for use.

BRIEF DESCRIPTION OF THE DRAWINGS

FIG. 1 is a system for providing financial details from a mobile device in accordance with an embodiment of the present invention;

FIG. 2 is an embodiment of a mobile device of the system of FIG. 1 in accordance with the present invention;

FIG. 3 a flow diagram of an embodiment of a method of operation of the system of FIG. 1;

FIG. 4 is an example of a financial detail structure used in the method of FIG. 3;

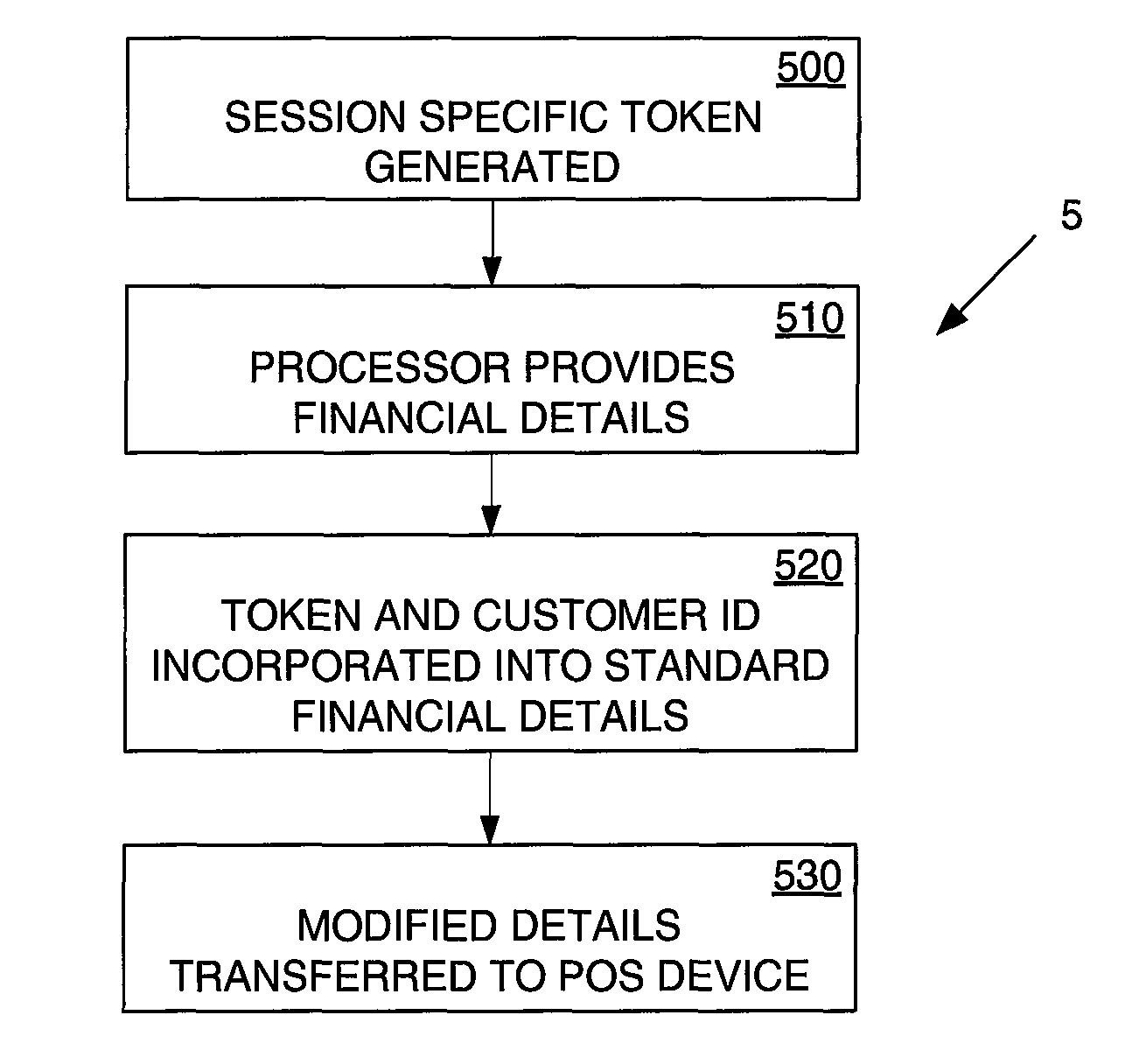

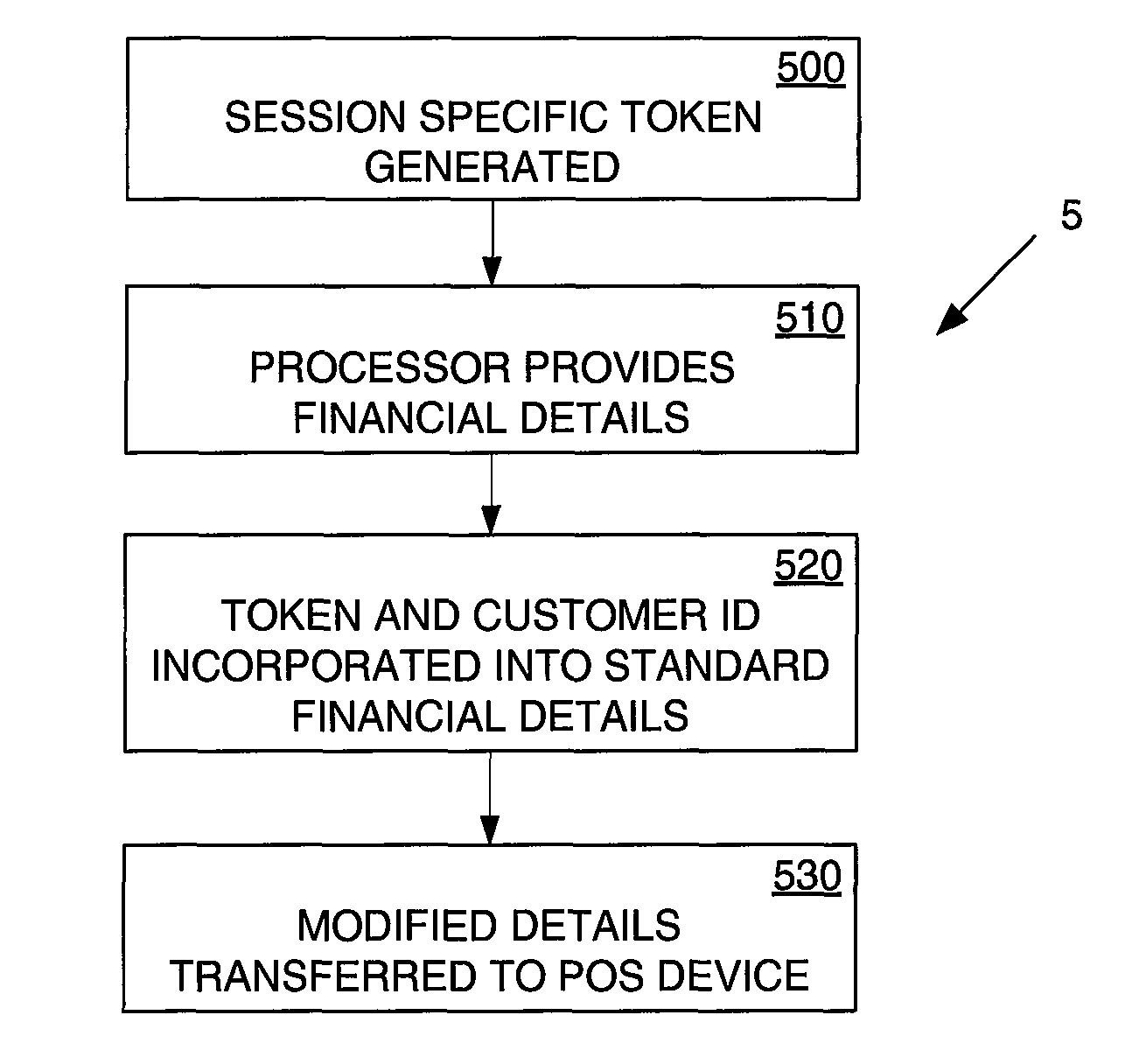

FIG. 5 is a flow diagram of an embodiment of a method performed on the mobile device of FIG. 2 in accordance with the present invention;

FIG. 6 is an embodiment of a server of the system of FIG. 1 in accordance with the present invention;

FIG. 7 is a flow diagram of an embodiment of a method in accordance with the present invention performed on the server of FIG. 6;

FIG. 8 is an embodiment of a system for providing financial details from a mobile device in accordance with a further embodiment of the invention;

FIG. 9 is a flow diagram of an embodiment of a method in accordance with the present invention performed at the server of the system of FIG. 8;

FIG. 10 is a second example of a financial detail structure used in a method of operation of the mobile device of FIG. 2;

FIG. 11 is a flow diagram of an embodiment of a method in accordance with the present invention performed on the mobile device of FIG. 2 and using the financial detail structure of FIG. 10;

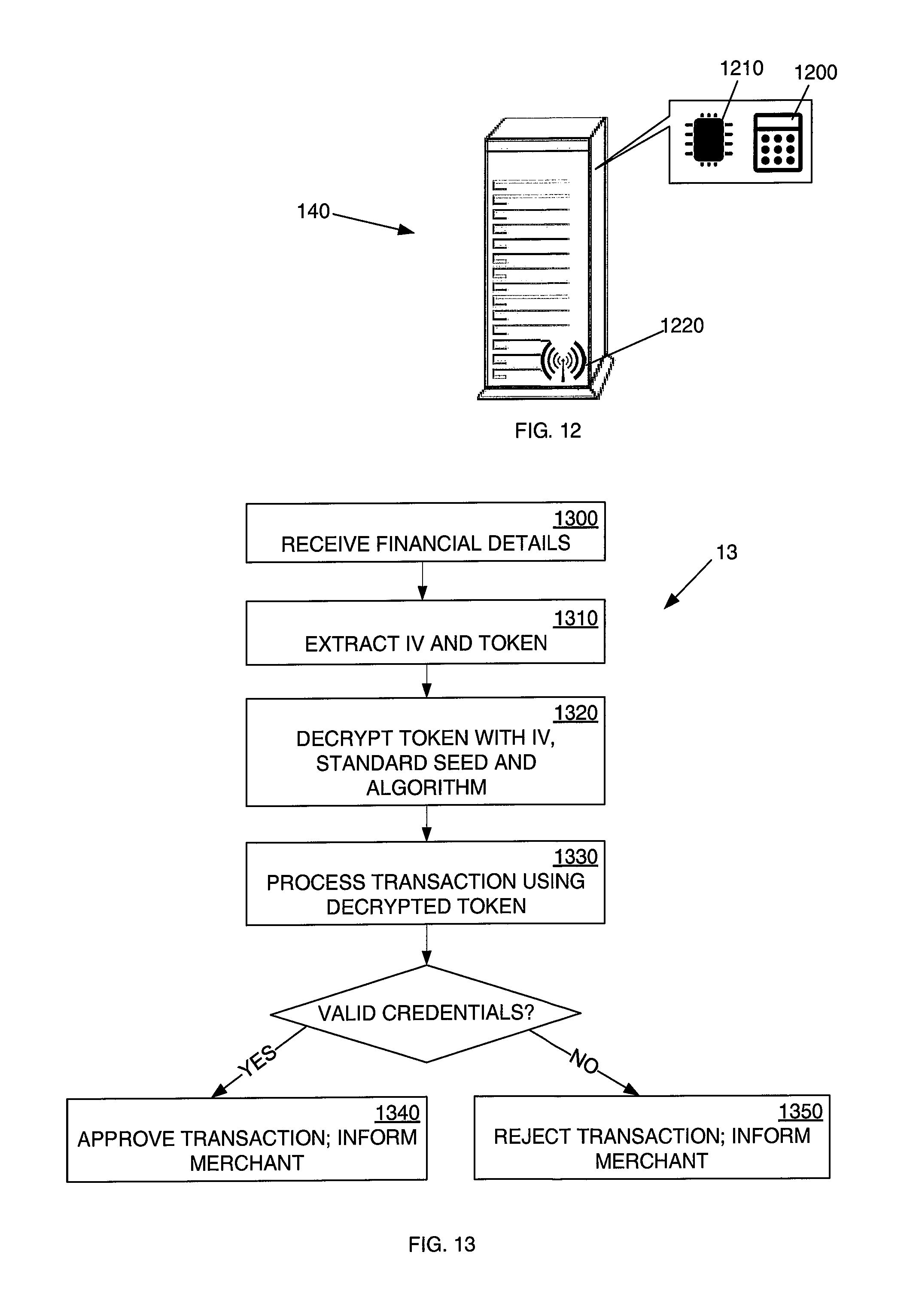

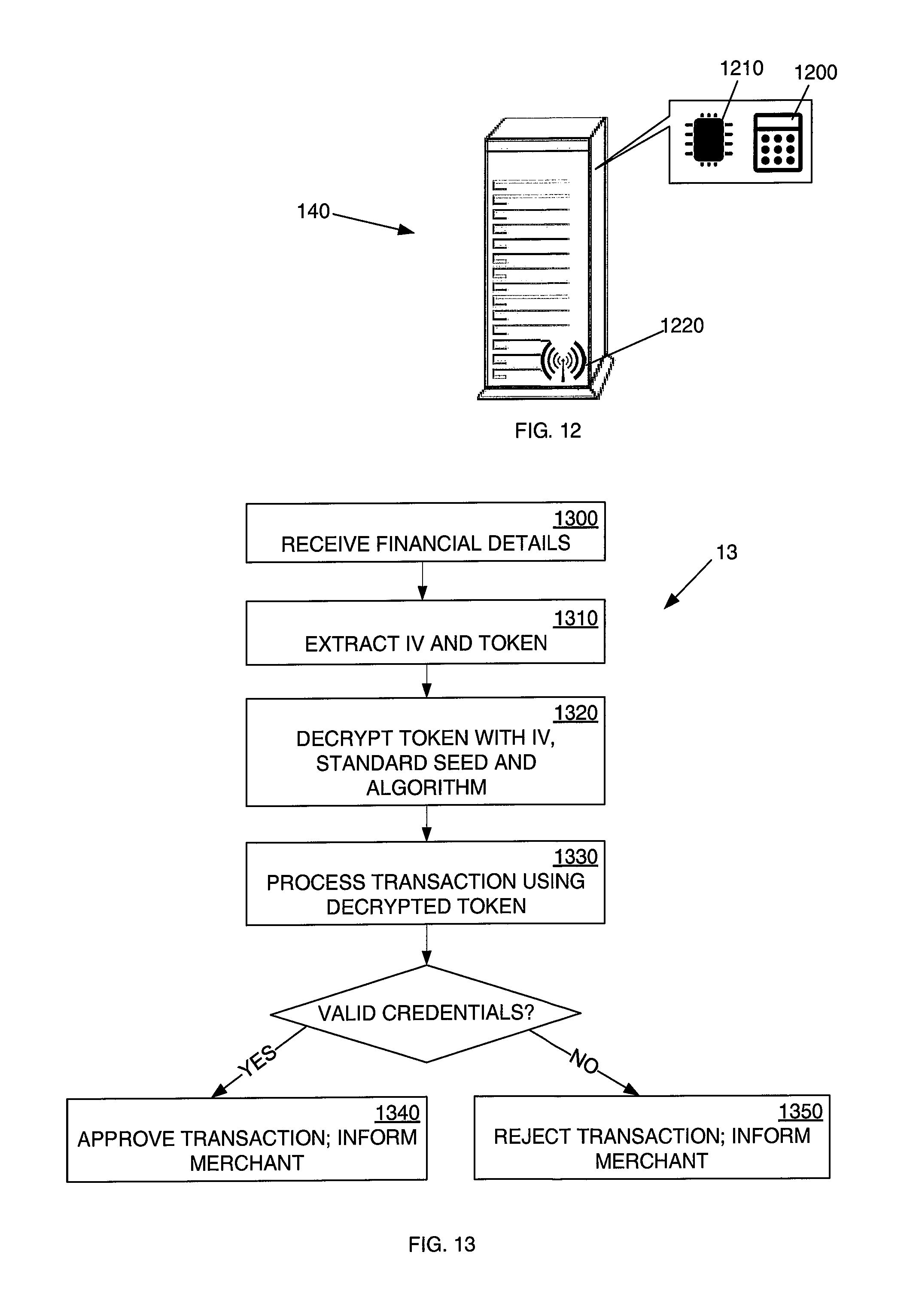

FIG. 12 is an embodiment of a server of the system of FIG. 1 in accordance with the present invention;

FIG. 13 is a flow diagram of an embodiment of a method in accordance with the present invention performed at the server of FIG. 12;

FIG. 14 is an embodiment of a computing device in accordance with the present invention; and

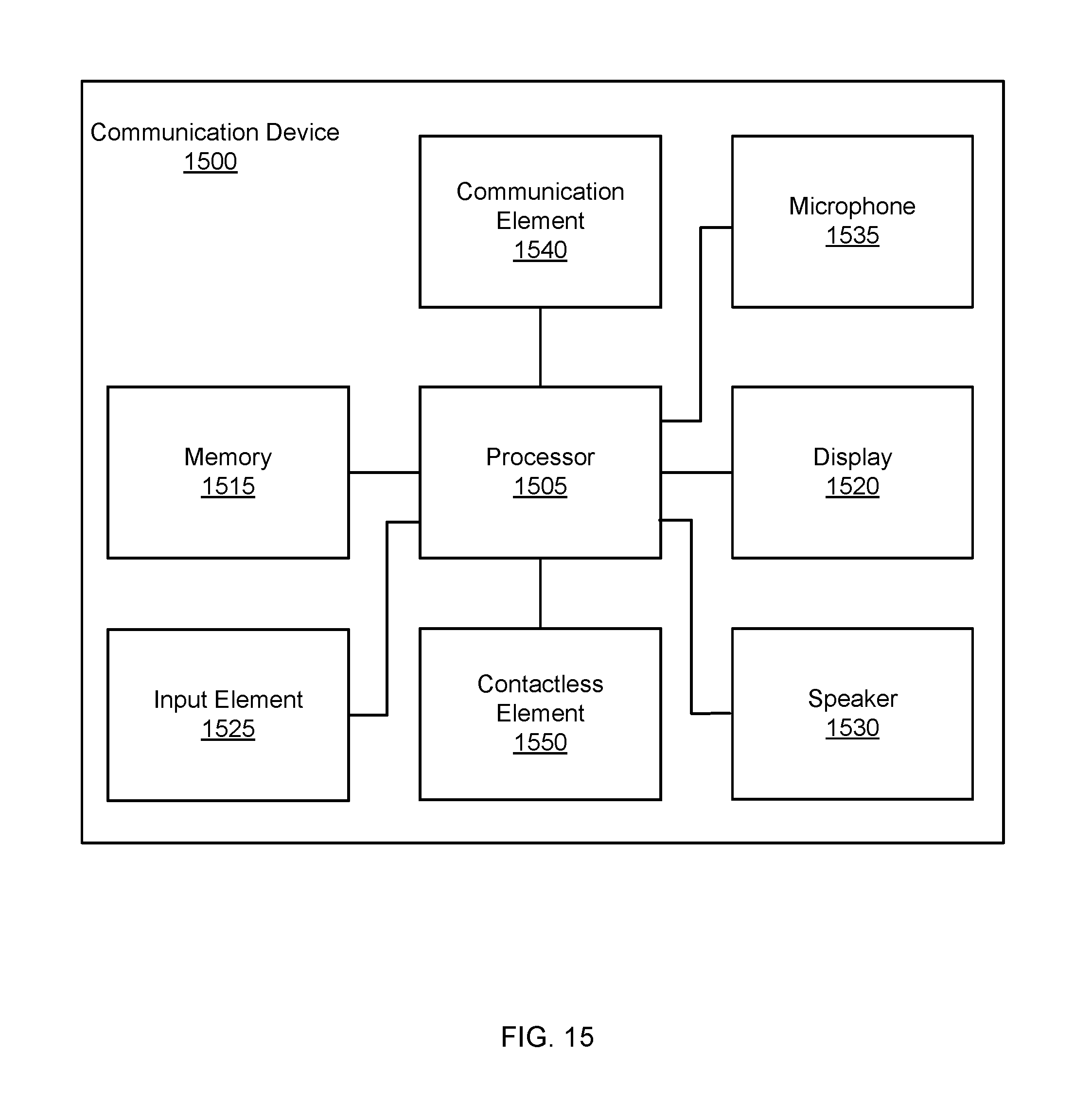

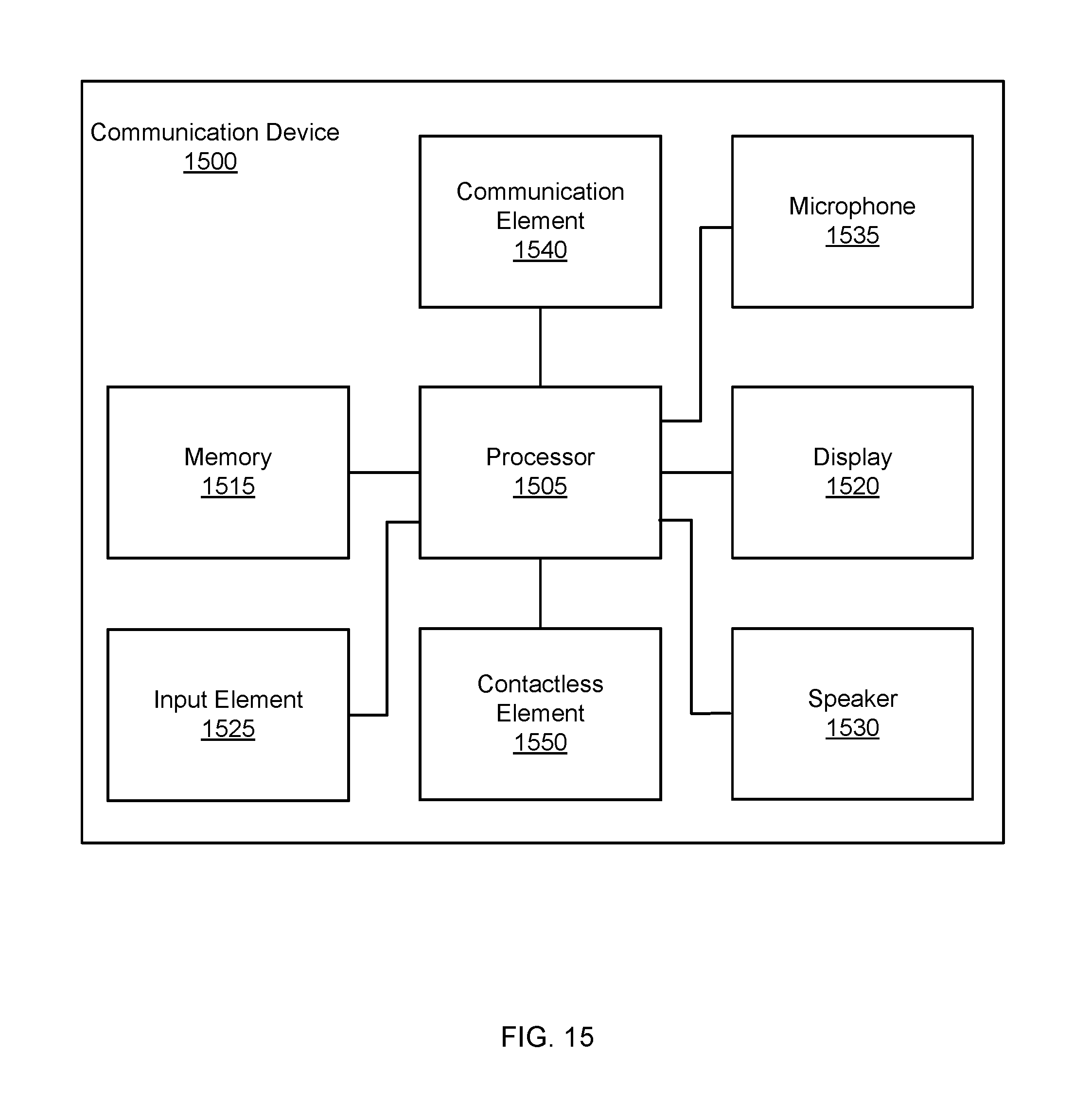

FIG. 15 is an embodiment of a block diagram of a communication device in accordance with the present invention.

DETAILED DESCRIPTION

FIG. 1 shows a system (1) for providing financial details from a mobile device. The system includes a mobile device (100) of a user (110), a point of sale terminal (120) of a merchant, and an issuing authority (130) at which the user (110) has an account. The issuing authority has associated therewith a server (140) and a database (150). In the present embodiment, the mobile device (100) is a smartphone, however the mobile device (100) may alternatively be a feature phone.

The mobile device (100) of FIG. 1 is shown in more detail in FIG. 2. The mobile device includes an encryption component, in the present embodiment a hardware security module (HSM) (200). The HSM includes a token generating component (210), a financial details component, in the present embodiment a non-volatile memory module (220), and a format modifying component, in the present embodiment a processor (230). The mobile device also has a communication component (240) by means of which it can receive and send data.

In at least one embodiment of the invention, the mobile device differs from devices that may solely use software to encrypt communications between an electronic device and a target device or system. An electronic device that solely uses software to encrypt communications may comply with only a security level 1 of the Federal Information Processing Standard 140-2 (FIPS 140-2), which provides only a minimum level of security to protect sensitive information. In contrast, the HSM within an electronic device or controller according to some embodiments of the invention is compliant with at least a security level 2 of the FIPS 140-2 standard. More preferably, the HSM within the electronic device or controller in embodiments of the invention is compliant with security level 3 or level 4 of FIPS 140-2.

The HSM in embodiments of the invention uses hardware to encrypt data instead of solely performing the encryption in software. The HSM provides enhanced protection over software encryption technologies. For example, the HSM provides secure key management to generate cryptographic keys, sets the capabilities and security limits of keys, implements key backup and recovery, prepares keys for storage and performs key revocation and destruction. In some embodiments, the HSM is implemented as a dual processor device that includes a secure processor with storage and a public processor with storage. The HSM may also include a physical or logical separation between interfaces that are used to communicate critical security parameters and other interfaces that are used to communicate other data. The HSM can also provide a tamper-proof mechanism that provides a high risk of destroying the HSM and the cryptographic keys stored therein, if any attempt is made to remove or externally access the HSM.

FIG. 3 shows a flow diagram of an example operation of the system of FIG. 1. When a user (110) wishes to transact with a merchant, the user indicates on an input component of the mobile device (100), typically a keyboard, that he or she wishes to generate financial details required to complete the transaction in a first step (301). The financial details are generated on the mobile device (100) of the user (110) in a next step (302), and are transmitted to the POS terminal (120) in a further step (303). From the POS terminal (120), the details are transmitted to the issuing authority (130) at which the user has an account in a next step (304). At the issuing authority (130), the validity of the financial details is verified in a next step (305). Finally, the merchant is informed of the result of the verification of the details in a final step (306).

The financial details are presented in a format compliant with POS devices. In the present embodiment of the invention, that format is Track 2 financial transaction card format. By using a data format that a point of sale device is used to handling, the least number of modifications need to be made to currently in-use POS terminals and transmission protocols to allow them to facilitate the operation of the invention.

Track 2 financial transaction card data include a number of digits in a pre-determined format. An example of data included in Track 2 data is shown in FIG. 4. The data includes a personal account number (PAN) field (400), which is made up of a bank identification number (BIN) field (401) of 6 characters and an account number field (402) of the user, of 10 characters. A BIN is an identifier of an institution who issued the financial data, such as an issuing authority, or of an issuing authority at which a user has an account. The account number includes a check digit (403) of a single character. Also included in the Track 2 data is an expiry date field (404) of 4 characters and a card verification value (CVV) field (405) of 3 characters. It should be noted that FIG. 4 only shows an extract of the data fields in Track 2 data, and that the actual format includes various other fields, such as field separators, and initialization fields, a termination field, as well as other data fields.

A method performed on the mobile device for providing financial details is illustrated in the flow diagram (5) shown in FIG. 5. The method is performed on a mobile device as illustrated in FIG. 2 and the reference numerals for the components of FIG. 2 are used.

In a first step (500), a session specific token is generated on the token generating component (210) of the mobile device. It is envisaged that the mobile device will only generate a session-specific token upon a request from the user to do so.

To generate the token, the token generating device uses an algorithm which is stored on the token generating component (210) in the HSM (200). The algorithm requires a seed value as input, the seed being unique to the user (110). The seed value is stored in the memory module (220). The algorithm further requires a dynamic key as an input value. In the present embodiment, the dynamic key used is a counter value which is also stored on the memory module. After each determination of a session-specific token using the algorithm and dynamic key, the counter is increased. The initial counter value and the seed value of a user are known by the issuing authority (130).

In a next step (510), the processor (230) provides financial details relating to a payment card of the user, in the present embodiment payment card details in the form of Track 2 data may be stored in the memory module (210).

In a next step (520), the session specific token is incorporated into data fields of the Track 2 data which is available for a part of the account number and the CVV and, optionally, the expiry date. In the present embodiment, these fields are not essential for the transfer of payment credentials, and may be considered redundant. In the present embodiment, three characters of the session-specific token are incorporated in a last part (407), before the check digit (403), of the account number field (402), and three characters are incorporated in the CVV field (405).

A first part (406) of the account number field (402) is used to transmit the customer ID number, which is stored in and retrieved from the memory module (220). In combination, the last part (407) of the account number field and the CVV field (405) provide space for a 6-digit token to be inserted. The result of the incorporated of the session-specific token and the customer ID number into the Track 2 data is a modified form of the financial details.

In a final step (530), the modified form of the financial details is transferred to a POS terminal that is still in a format compatible with the POS terminal. In effect, certain numeric characters in the Track 2 data have been altered.

The point of sale device transmits the modified form of the financial details received to the issuing authority (130) in a similar manner as is currently known for transactions involving a physical payment card. The modified form of the financial details is sent along with details of the transaction, including, for example, the price payable and a merchant identifier, as is common practice in payment systems using POS terminals. The BIN number (401) indicates to the POS terminal to which issuing authority the details are to be sent.

An embodiment of the server (140) of FIG. 1 is shown in more detail in FIG. 6. The server (140) includes a token generating component (610), an extraction component, and a comparison component. In the present embodiment, the extraction component and the comparison component are provided by a processor (620). The server also has a communication component (630) by means of which data can be sent and received. The communications component functions as both a receiving component and a transmission component, for receiving and transmitting data.

A flow diagram (7) illustrating the method followed by the server (140) of a issuing authority in determining the validity of received financial details in accordance with an embodiment of the invention is illustrated in FIG. 7. In a first step (700), the issuing authority receives financial details in an expected format. In the present embodiment, the expected format is a modified form of the Track 2 data as described above.

Since a customer ID number is contained in the first part (407) of the account number field (402) in an unaltered form, the server can extract the customer ID number directly from the details received in a next step (710). Since the fields in which a session-specific token should be included are also known to the issuing authority, a token is also extracted by the server in this step (710) from the last part (406) of the account number field (402) and the CVV field (405).

The database (150) has stored thereon a list containing the details of user accounts, including the customer ID number of each user account and the counter value and seed value associated with each user account. The counter value and seed are retrieved by the server in a next step (720), by looking up the key and seed associated with the customer ID number extracted from the financial details received in the previous step (710).

In a next step (730), the server applies an algorithm related to the algorithm that is stored on the memory module (220) of the HSM (200) on the user's mobile device (100), using the seed value and counter value retrieved from the database (150), to obtain an expected session-specific token. The server utilizes its token-generating component (710) for calculating expected session-specific tokens.

The server then compares the expected session-specific token to the received token in a next step (740). If the tokens match, the transaction is approved, and an approval message is transmitted to the merchant in a final step (750) via the communication component (730). If the tokens do not match, the transaction is rejected, and a rejection or failure message is transmitted to the merchant in a final step (760) via the communication component (730). If the transaction is approved, the server is expected to deal with the transfer of money in a standard manner. After a successful comparison, the counter value stored in the database relating to the user account concerned is increased in the same manner as it would have occurred on the user's mobile device when then session-specific key was originally generated. The approval or rejection message may also be sent to the user's mobile device.

It is envisaged that the seed value may constitute the dynamic key itself. In such a situation, only the dynamic key will be used as input value for generating a session-specific token, and the server will only need to look up the dynamic key to generate the same token instead of looking up the dynamic key and the seed value.

It should be noted that in the embodiment described above, the session-specific token is generated without a direct communication channel to the issuing authority. Therefore, the token generation can be considered as offline token generation, wherein the validity of the token can be assessed by the issuing authority at a later stage.